Uncovering Growth: Wellness Real Estate Across the Market

An increased focus on health is supercharging investment in industries, and within real estate, the outcome is an expanding market with outsized value.

Identifying growth opportunities in today’s low-growth real estate market is challenging. From economic uncertainty to lack of investment, the outlook is sluggish. However, through an analysis of evolving preferences, spending patterns, and behaviors, it is possible to reveal where people are demanding more from the spaces they live, work, and play, and how real estate is evolving to meet those needs.

Over the past several years, an increased emphasis on physical, emotional, and social health has had a significant impact on the goods, services, and spaces that support peoples’ overall well-being. This increased focus on health is supercharging investment in industries that comprise the rapidly developing wellness economy, and within real estate, the outcome is the intentional design and delivery of projects across sectors that holistically support individuals and communities within the built environment.

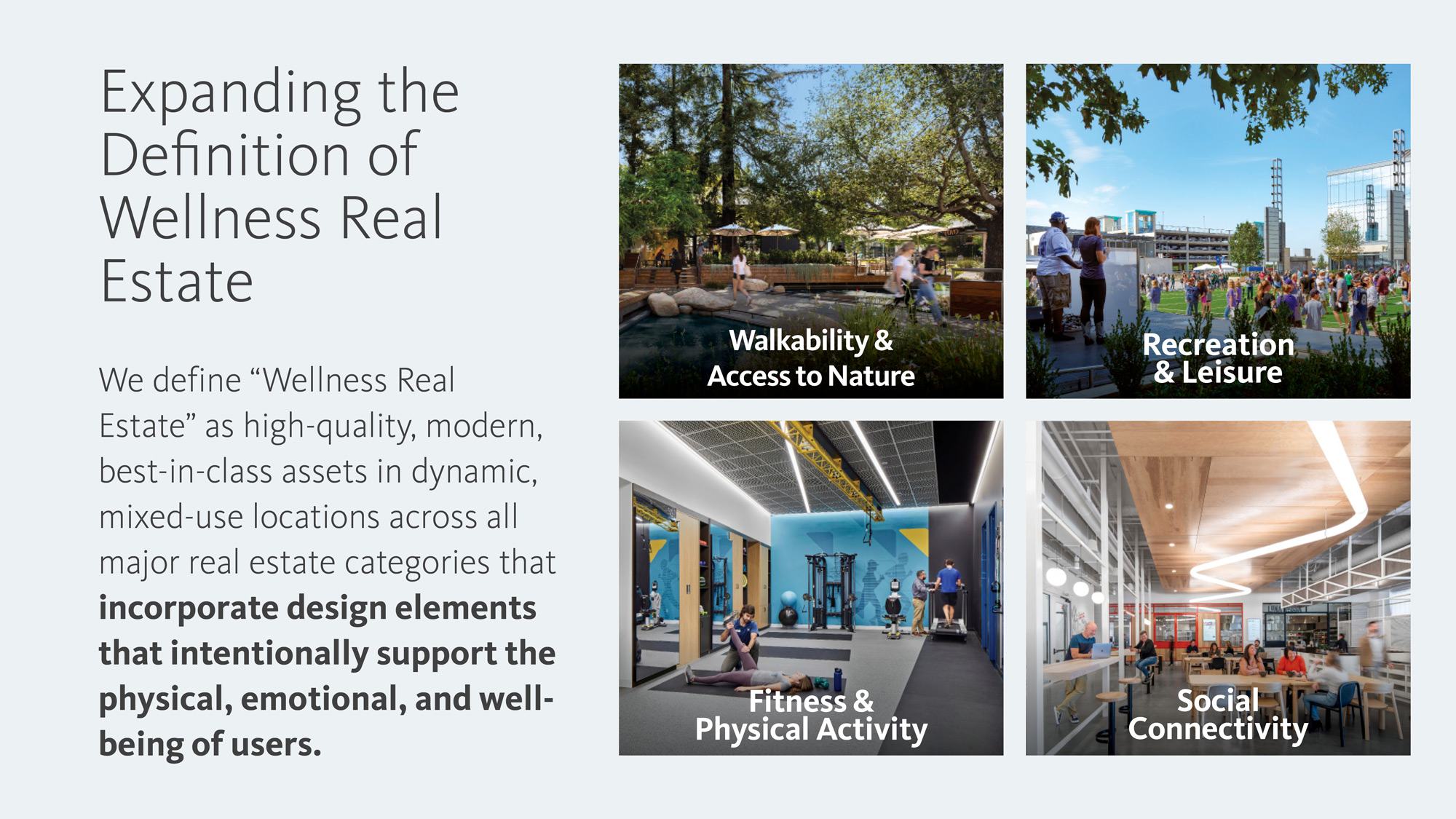

The Global Wellness Institute (GWI) has been at the forefront of researching the Wellness industry for over the past 15 years. Defining wellness real estate as real estate that “explicitly puts people’s wellness at the center of the conception, design, creation and redevelopment,” they have studied how these principles are applied, primarily within the realm of residential real estate, and charted growth year over year. These drivers, however, are not confined to residential. They are also at play across all real estate sectors, from workplace to retail to hospitality. In applying this definition to all real estate by identifying and measuring specific design elements that intentionally support the physical, emotional, and social well-being of users, new opportunities for development emerge and wellness becomes elevated to a multiplier of demand and investment.

The Opportunity

Utilizing this expanded definition, Gensler’s analytics team and experts from our wellness practice quantified the broader wellness real estate market and what it means in terms of growth across all sectors. What we found is a large, expanding industry whose growth and value significantly outpaces each sector as a whole.

We estimate the value of the collective U.S. wellness real estate market to be over $580 billion — more than three times the estimate developed by the Global Wellness Institute. While still a small portion of the overall real estate market, 1.4%-3.0% depending on the sector, wellness real estate is growing quickly, with 10-year average growth rates at least four times higher than each sector’s overall market. When looking at performance, wellness real estate again exceeds the overall market, commanding revenue premiums anywhere between 24%-146% depending on the sector.

Additionally, these shifts and premiums are taking place throughout the country, in markets both small and large. For example, cities like Washington, D.C., Boston, and Phoenix are seeing high demand for wellness real estate in the office market, where these spaces are commanding up to a 30% rent premium over the average property. In markets as diverse as Houston, Atlanta, and Detroit, wellness multifamily properties have higher occupancy rates than their citywide averages.

What Does Wellness Real Estate Look Like Across Markets?

Gensler has led the design and development of many projects that are defining and evolving wellness real estate. In the workplace sector, new office developments like Marriott International Global Headquarters and The Post Office are incorporating deliberate program and design features that empower tenants to prioritize physical wellness and mindfulness throughout the day. From common amenities like fitness centers and access to the outdoors, to emerging services like daycare facilities, concierge services, and deep focus zones, these workplaces are driving engagement and performance that extends from the building into the community.

In the multifamily residential sector, wellness design is spanning across all scales of a development. Whether it is the integration of biophilic design elements to create enhanced spaces of respite in units like Solhouse 6035 or the creation of amenity hubs that foster community and a sense of belonging to residents, like at Prairie Shores in Chicago, these projects are holistically addressing individuals' needs while simultaneously supporting a vibrant lifestyle ecosystem.

The hospitality industry has enjoyed a longstanding relationship with wellness spaces. High-end hotel brands, wellness retreats, and vacation destinations such as Nekajui Ritz Carlton Reserve or Surf Simply that actively market wellness services and amenities like day spas or retreat packages boast the highest revenue premium across sectors, accounting for nearly all of the sector’s growth.

For retail developments, retailers and consumers are increasingly drawn to mixed-use, walkable lifestyle developments that emphasize pedestrian-friendly atmospheres with open space and programming. Mixed-use projects like the Domain Northside and Fifth + Broadway with ground floor retail that encourages movement and drives social connection through food, entertainment, and brand engagements are thriving and delivering a new range of experiences.

As health and wellness continue to be critical focuses for consumers, real estate end users will continue to demand environments that promote a holistic approach and integration of wellness programs, services, and design. Not only will these projects enhance individual and community wellbeing, they will also achieve higher market performance and interest from the real estate investment community to leverage the wellness multiplier and act on these growth opportunities.

For media inquiries, email .