Trends to Watch Shaping the Future of Wellness

Gensler’s Wellness leaders discuss the opportunities shaping the future of wellness, from wellness real estate to inclusive design.

Editor’s Note: This blog is part of our Design Forecast blog series, looking at what’s next in 2025 and beyond.

Across industries, organizations are recognizing the benefits of integrating wellness into their operations to enhance experiences and drive measurable economic benefits. We sat down with Michael Schur and Stacey Olson, global leaders for Gensler’s Wellness practice to discuss the rising interest in the wellness ecosystem across every real estate sector.

What’s the state of the industry like right now, and what’s driving the tremendous interest in wellness across all sectors of the real estate market?

Michael Schur: Today, the wellness industry is thriving. Across markets and sectors, rising awareness and expectation around health and well-being are reshaping decision-making and influencing aspects of business strategy, consumer behavior, and the built environment. This heightened focus is transforming spending habits, policy frameworks, and the design of physical and digital experiences — unlocking exciting new opportunities and accelerating the development of products and services that integrate multiple dimensions of well-being. When applied to real estate, these market forces, regulatory shifts, and technology advancements are fueling growth in sectors that have otherwise remained stagnant.

Stacey Olson: Individuals continue to drive the wellness conversation, while companies are navigating how to respond to the myriads of challenges they’re experiencing today — addressing burnout, the shrinking labor pool, and how to retain a competitive advantage.

Companies are recognizing the vital role that wellness communication strategies play in attracting and retaining talent. Strategies that build or rebuild culture, community, and togetherness are taking center spotlight. Some examples include the adoption of new and better programs that support mental, physical, and reproductive health. Simultaneously, existing policies are being revised to reflect the changing landscape of state and federal regulations and policies — resulting in a shift in the language being used, and the ways results are quantified.

What’s driving the trend for “wellness real estate”? How is wellness driving premium values for multiple asset types?

Michael: Wellness spending in the U.S. is at an all-time high — and it’s making a significant impact. According to the Global Wellness Institute, the U.S. spends more per capita on wellness than any other country, with its $2 trillion wellness economy accounting for one-third of the global market. This level of spending is reshaping real estate demand, as consumers, businesses, and investors increasingly prioritize wellness-centered spaces. With a growing awareness of how the built environment influences physical, mental, and social well-being, there is heightened demand for better indoor air quality, greater access to nature and walkable communities, and flexible, health-supportive environments that promote physical activity and social connectivity.

The result is a cross-segment response that is not only meeting market demand, but also delivering significant growth and financial returns. According to our estimates, across single-family and multifamily housing, retail, office, and hospitality segments, wellness real estate in the U.S. has a four times higher 10-year average growth rate than those of their respective sectors. And developments that incorporate wellness-focused amenities — such as concierge services, deep-focus and respite spaces, outdoor access, and community building programming centered on food, entertainment, and social connection — are achieving revenue premiums of 24% to 146%, depending on the segment.

How are organizations looking beyond physical space to things like policy and programming to embrace a “wellness ecosystem” approach?

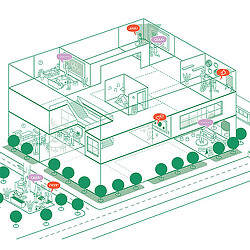

Stacey: While we spend more than 90% of our lives indoors, our clients are realizing that even with the best design, they cannot create the ecosystem for measurable wellness outcomes without reexamining their programming and policies. Our clients want to provide cultures that foster collaboration, innovation, and ideation organically. As co-benefits, these spaces provide better environments for improved inclusivity and mental health. This might manifest in physical space, but it often begins with policy and is reinforced by design guidelines.

When we talk about creating a feeling of inclusion, safety, and access by all people, it’s about designing for the edges. If you’re designing for a neurodivergent population or using trauma-informed design or Deaf Space principles, and you’re designing for every age, gender, and religion, your programming is different. Your policies are different. And your space feels different because it is.

These kinds of spaces have intuitive wayfinding, modified color pallets and textures, and comprehensive integration of biophilia and biomimicry. They also leverage the concept of prospect and refuge, and feature amenities that are rich and varied — like sensory rooms, multi-faith prayer rooms, coworking, mother’s suites, and play space — in addition to standard amenities. While these spaces may be designed for the edges, all people benefit from the richness these workspaces offer, which earns the commute of employees who work there and spurs a creative culture.

Michael: We are also seeing wellness act as the link between different facets of an organization, acting as a bridge between the makers of physical space and the makers of organizational policy. Throughout the design process, we are continually pushing to expand and connect how space can improve people-centered initiatives and how policies and programs can drive increased utilization and performance of physical investments.

How are clients looking to gain increased understanding of chemicals of concern and healthier materials?

Stacey: There are over 86,000 chemicals in circulation within our supply chain, with another 2,500 added annually. The public is becoming increasingly aware of these chemicals, especially given the rise in incidence of those diagnosed with autoimmune diseases, allergies, asthma, sensitive skin, cancer, and more. Every day, we see new scientific studies emerging, aligning plastics and long-term chemical exposure with negative health effects; however, performing those chemical risk assessments is a long and laborious process.

Meanwhile, regulatory infrastructure systems (like the EPA, OSHA, and FDA) are simply not equipped to keep pace with the speed of industry. Increasingly, we’re seeing companies reexamining their specifications to remove building materials that have endocrine disrupting chemicals, phthalates, bisphenols, PFAs, and forever chemicals.

Our clients want to convey to their employees, customers, and clients that they care about their health — and not just by providing healthcare. They’re altering their construction specifications, which has a trickle-down effect of changing the supply chain demand to one that opts out of chemicals. This extends to every space typology — from offices to manufacturing, airports, and even data and distribution centers.

Why are employers increasingly investing in wellness strategies that have measurable impact?

Michael: In 2023, the Charles Schwab Modern Wealth Survey revealed that Americans valued well-being and healthy relationships equally — if not more — than financial aspects when defining wealth. Put another way, “health is the new wealth.” This shift has not gone unnoticed by employers across industries as they increasingly look to develop actionable plans and approaches that differentiate themselves in the market, retain and holistically support their greatest assets — their people — and foster a high-performing and engaging culture.

Stacey: While staff and tenants are leading the demand for wellness, many of our clients are also asking for health, well-being, and sustainable strategies because their stakeholders are demanding it. When constituents demand performance metrics, they’re looking or quality data that’s science-based and third party-verifiable and devoid of “well-being washing.”

Companies want data that demonstrates value and impact. Wellness KPIs need to respond accordingly. Today’s wellness strategies must address some of our clients’ toughest challenges — from economics to talent shortages to climate change — all while creating competitive advantage, which requires a multifaceted approach. This provides not only monetary gains but also improves health and well-being — a win-win for today’s business leaders.

For media inquiries, email .