Creating Meaningful Customer Relationships in the Midst of a Merger

By Ryan Cavanaugh

Mergers of any financial institutions have the power to affect the economy, from large corporations to family-owned businesses, and most importantly, consumers. With 2020 set to be the biggest year for bank mergers since the early ‘90s, customer experience and retention will be at risk. A merger has a profound impact on the customer experience, but also provides an opportunity to re-focus on what is working for current customers and determine how best to target and serve new ones.

The recipe should be simple: create meaningful relationships with customers — and design a physical branch that serves as an incubator for those relationships. While this is a constant challenge for retail banks already, it is even more important to deliver a consistent, authentic experience to a new client base during a merger.

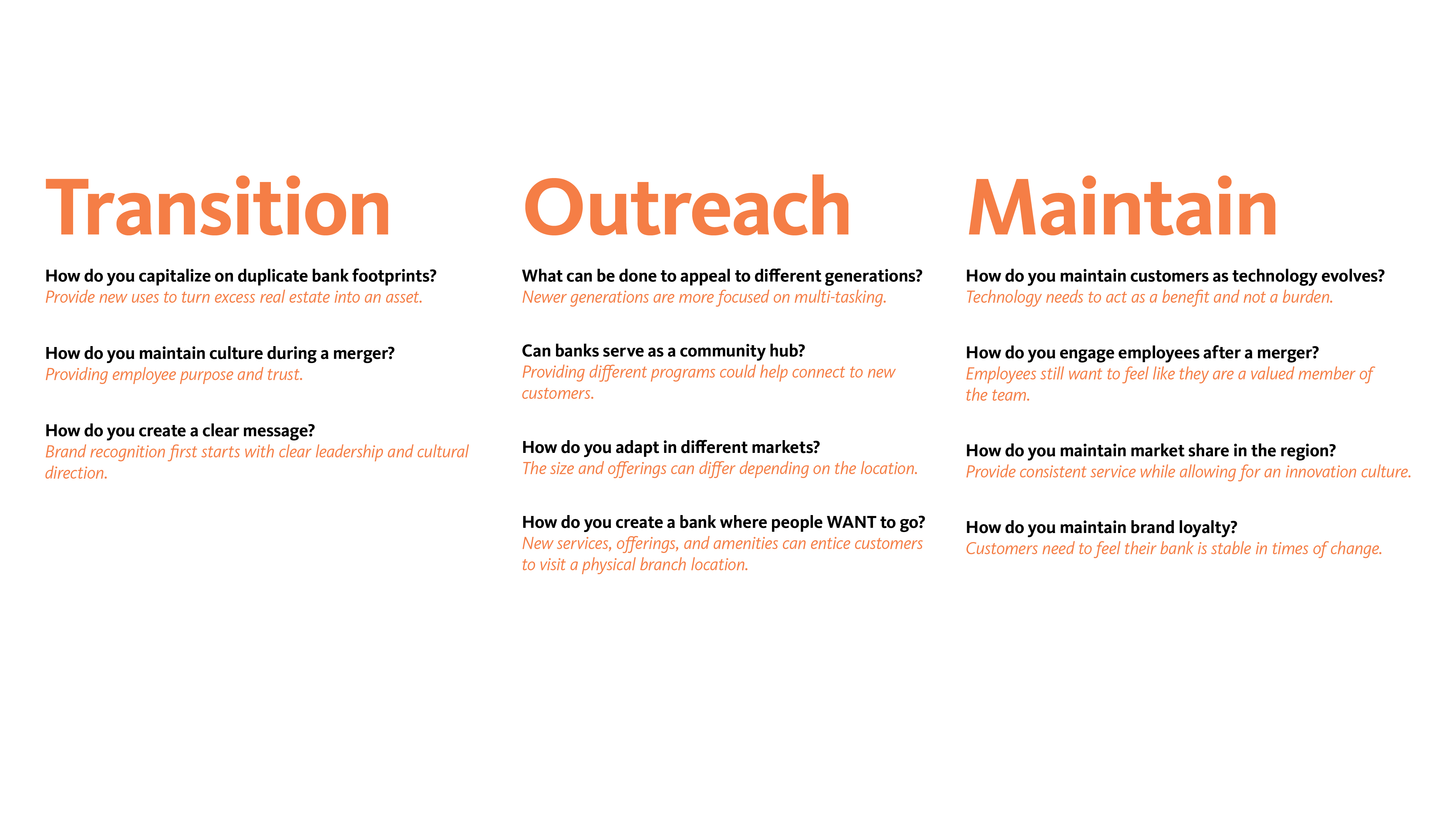

As part of Gensler’s Southeast Emerge program, an internal leadership program that encourages rising leaders within the firm to build outside relationships around a topic of shared interest, our group explored the impact of corporate mergers on customer experience and the role space can play. We determined that a successful merger can be organized into three areas that form a framework around community engagement: transition, outreach, and maintain.

With this framework in place, our group created a sample list of questions below that can help merging organizations connect with their existing customers and strengthen relationships in the future. For example: what can be done to appeal to different generations? Considering that the greatest wealth transition in history is set to occur over the next 25 years, as boomers pass on $68 trillion to the next generation, how is your bank taking the steps now to gain that market share?

The largest target for growth for any savvy bank right now is the HENRY, the “High Earning, Not Rich Yet,” primarily millennial group. Using focus groups and surveys, we found that most individuals in this category still chose their bank due to the convenience of a physical bank location. Meaning these banks have the greatest opportunity to connect with HENRYs — and maintain relationships as their wealth grows. On the other hand, when asked how important a physical location was, responders averaged a 5.13 out of 10. What respondents really wanted to see were banks that “break the mold,” embrace digital tools and emphasize ease of use.

Additionally, our research found that it is important for customers to see how the brand handles the customer after the initial transaction. We’ve identified a few ways for financial institutions to connect with this demographic and prepare future generations:

1. Provide usable space beyond traditional banking.

Engage with your target market by creating different opportunities to connect such as hosting seminars for small businesses, students, and other future customers. Incorporate events outside of your industry such as an artist showcase for local makers and vendors.

2. Differentiate your brand by providing exclusive experiences.

What are the opportunities for brand engagement? What are the perks of being a customer with your bank? Perhaps if you are targeting small businesses, the space can offer networking events for small business owners that bank with you.

3. Elevate the customer experience by providing amenities.

With so many digital touchpoints, banks need less space for items such as vaults, safes, and even ATMs and traditional teller lines. The reclaimed square footage can then become space shared among clients and customers, where they can get work done, hold a meeting, or host their own event.

Understanding the HENRY group means understanding generational distances and how your brand will adapt as client base changes. Younger digital natives are not brand loyal and are motivated by price and shared values, presenting a new challenge for financial institutions and their future mergers or dissolutions. They are generally more socially and environmentally conscious than their preceding generations but unwilling to pay a higher price. This is an opportunity for banks to reaffirm their values and engage with these current or potential clients while they are entering the work force.

Creating flexible physical spaces is a critical tool in the arsenal of a successful financial service brand. Now, more than ever, it is the epicenter of your customer touch point strategy, and if done correctly can propel your brand to new heights.

For media inquiries, email .