To answer the question, we looked into what’s really motivating people today — and some of the results are surprising. Our research found that after years of pandemic-related isolation and social distancing, physical environments are more important than ever for creating positive, memorable experiences. However, consumers now expect a seamless integration of digital and physical environments. And while buying goods, services, and experiences remains at the heart of many transactions, consumers of every age and income level are also looking for a deeper sense of fulfillment and entertainment when engaging with brands.

The call to action is clear: the internet, AI, social media, and influencer culture are all affecting how we think about experience. Ultimately, the most successful experiences are designed to nurture belonging, delight, and connection. But we must prioritize functionality and service for that connection to happen.

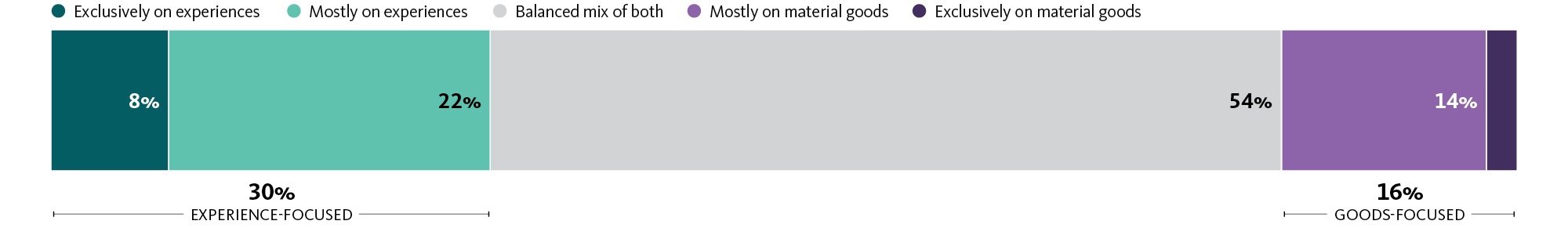

There are two types of people: goods-focused and experience-focused.

More than half of consumers of all ages prefer a balanced mix of experience- and goods-focused purchases. However, experience- and goods-focused consumers express different spending priorities and motivations. Experience-focused consumers are more likely to direct discretionary funds toward travel and vacations, live performances, cultural events, live sporting events, and outdoor recreation. They are motivated by pursuing cultural enrichment, exploration, connection (both with nature and with others), and being active. They look to their purchases to expand their worldviews and bring them in contact with something larger than themselves.

People are twice as likely to spend extra money on experiences than material goods.

The percentage of respondents who selected each answer.

Bad service can make even the best designs irrelevant.

When you combine great service and great design, experiences become exponentially better. Our data shows that the three most memorable aspects of a positive consumer experience are the quality of the products or services, exceptional customer service, and a welcoming or inviting atmosphere. When perceived poorly, staff and product quality also emerge as top drivers of a negative consumer experience. It indicates a strong need among consumers to feel that they are taken care of throughout their experience and that the products and services meet their expectations. Tensions between consumers and customer service providers seem to be reaching a particularly critical point — just 1/3 of respondents say they typically enjoy their interactions with sales personnel or service providers.

Unpleasant staff, product shortages, and long waits are key to negative experiences.

The percentage of respondents who selected each answer. Respondents could select up to 7 answers.

Digital engagement adds value — but only if it makes things easier.

It has never been more vital to understand how to effectively use digital spaces to engage and interact with consumers. As with consumer experiences in general, frills like interactivity and personalization fall behind the basics when people are asked about what they value most. The number one quality that consumers are looking for in digital interactions with a brand is an easy-to-use website or app, followed by order tracking and updates. Detailed product or service information, responsive customer support, and a seamless payment process rounded out the list of desired qualities. Convenience, information, support, and ease form the backbone of a frictionless digital experience for consumers.

Getting the basics right is vital for digital interactions.

The percentage of respondents who selected each answer. Respondents could select multiple answers.

U.S. Consumer Experience Report 2024 Methodology

We conducted semi-structured, video interviews with 15 subject matter experts across Gensler’s Lifestyle sector. These experts specialize in a variety of practice areas: culture and museums, digital experience design, entertainment and immersive experiences, hospitality, retail, sports, and experience strategy. We conducted thematic analyses and coding of the interviews to determine and synthesize recurring themes.

Responses to the U.S. Consumer Experience Survey were collected online via an anonymous, opt-in panel of 2,038 U.S.-based consumers between August 3 and September 29, 2023. Respondents were recruited by Qualtrics, a third-party panel aggregator and survey technology platform. We worked with Qualtrics to ensure wide distributions across personal characteristics, such as age (18+), gender identity, racial/ethnic identity, household income, employment status, and home region.

Download the full U.S. Consumer Experience Report 2024 to learn what makes an experience worth it.