How a New Vision for Flexible Co-Living Conversions Can Support Housing Affordability

Gensler and The Pew Charitable Trusts studied building typologies in five cities to better understand the potential found in this unique office-to-residential conversion model.

Editor's Note: this article was originally published in October 2024. It has been updated to include the latest study data and renderings from Los Angeles and Houston.

Cities across the United States are grappling with a long-term housing affordability crisis. The misalignment of housing costs and the housing budgets of renters is worsening, with a record 50% of renters cost-burdened, spending more than 30% of their income on rent. In many cases, this is exacerbated by regulatory frameworks that encourage and prioritize construction of traditional, market-rate housing that is higher-cost and beyond the means of most renters.

At the same time, office occupancy has fallen significantly nationwide as the real estate market responds to declining office demand, leaving many downtown properties vacant. These properties are located in transit-accessible and job- and amenity-rich locations. Gensler has assessed thousands of these office properties for their possible conversion to housing. However, many are not economically viable due to configurations that appeal to office tenants but are incompatible with traditional residential layouts. Large floor plates with little interior natural light, inoperable windows, and the high costs of plumbing and mechanical retrofits all challenge the design and economic feasibility of conversions, particularly under current regulatory frameworks in most cities.

In the mid-20th century, cities had a significant stock of single-room occupancy (SRO) dwellings, which offered a flexible, low-cost housing option that housed millions of residents across the country. Starting in the 1960s, restrictive zoning and building codes resulted in the elimination of SROs as an affordable housing alternative. These properties had flaws, but they did provide a much-needed supply of affordable housing by keeping costs low. We examined and learned from these past models to understand how we can reintroduce a safe co-living concept that can address housing affordability and meet the needs of today’s renters.

Introducing the Office-to-Flexible-Co-Living Conversion

We asked: what if we could reintroduce a version of this typology in the form of a modern, flexible co-living model, and what if vacant office buildings are the key to making it feasible? The reintroduction of flexible co-living residential typologies has the potential to:

- Reduce the costs of additional residential inventory.

- Increase the supply of available housing to lower-income renters.

- Alleviate some of the negative impacts of long-term demand changes for office properties.

Gensler partnered with The Pew Charitable Trusts (Pew) to develop a flexible co-living concept and assess its potential as an office conversion. An initial study was conducted for five cities: Denver, Minneapolis, Seattle, Los Angeles, and Houston, with additional locations to follow. The team selected these five cities because they have a high level of need — grappling with high median rents, a high rate of homelessness, and/or high downtown office vacancies. Most importantly, they have minimal or no regulatory barriers in place that would make these types of renovations illegal or too expensive.

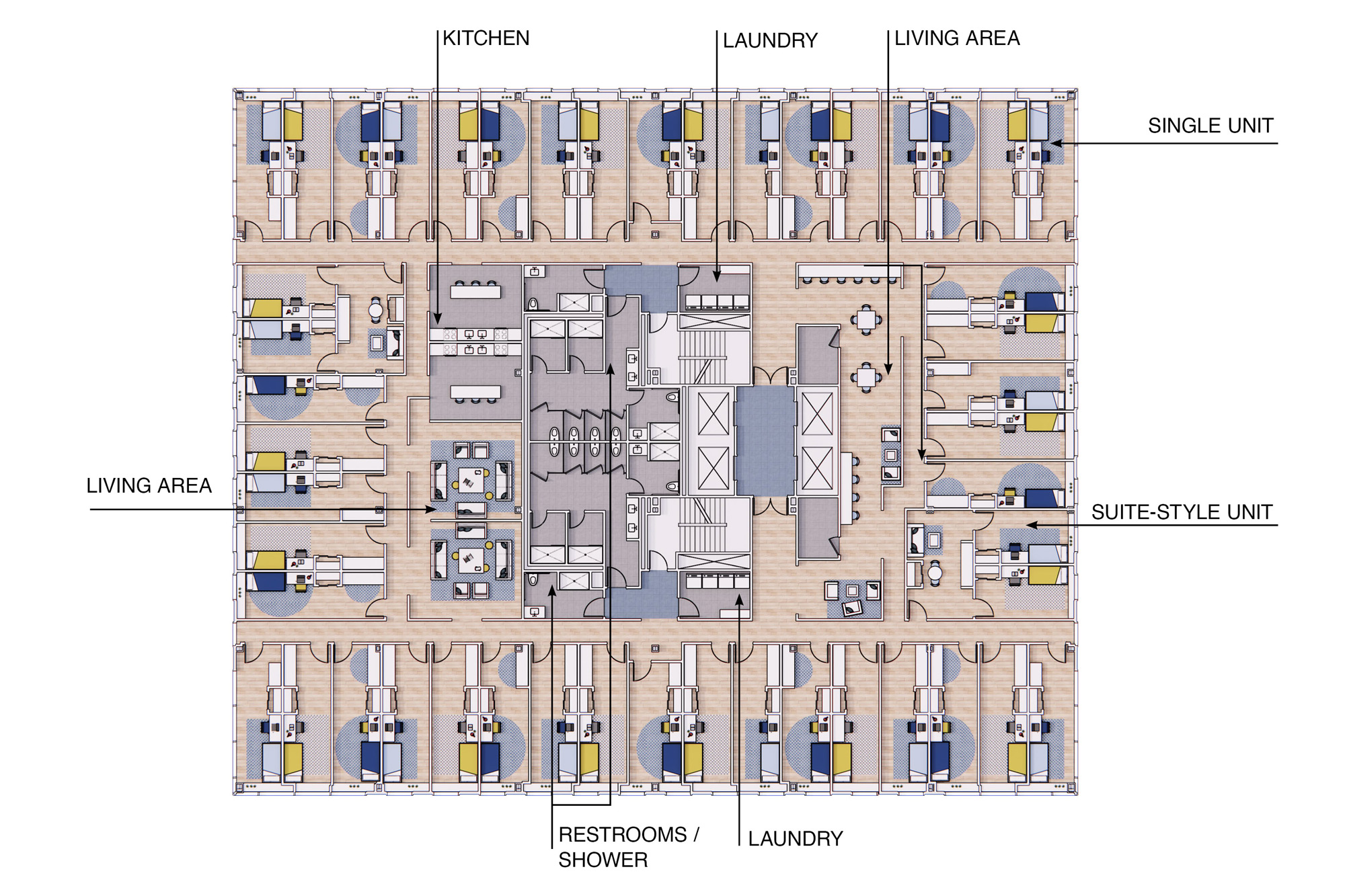

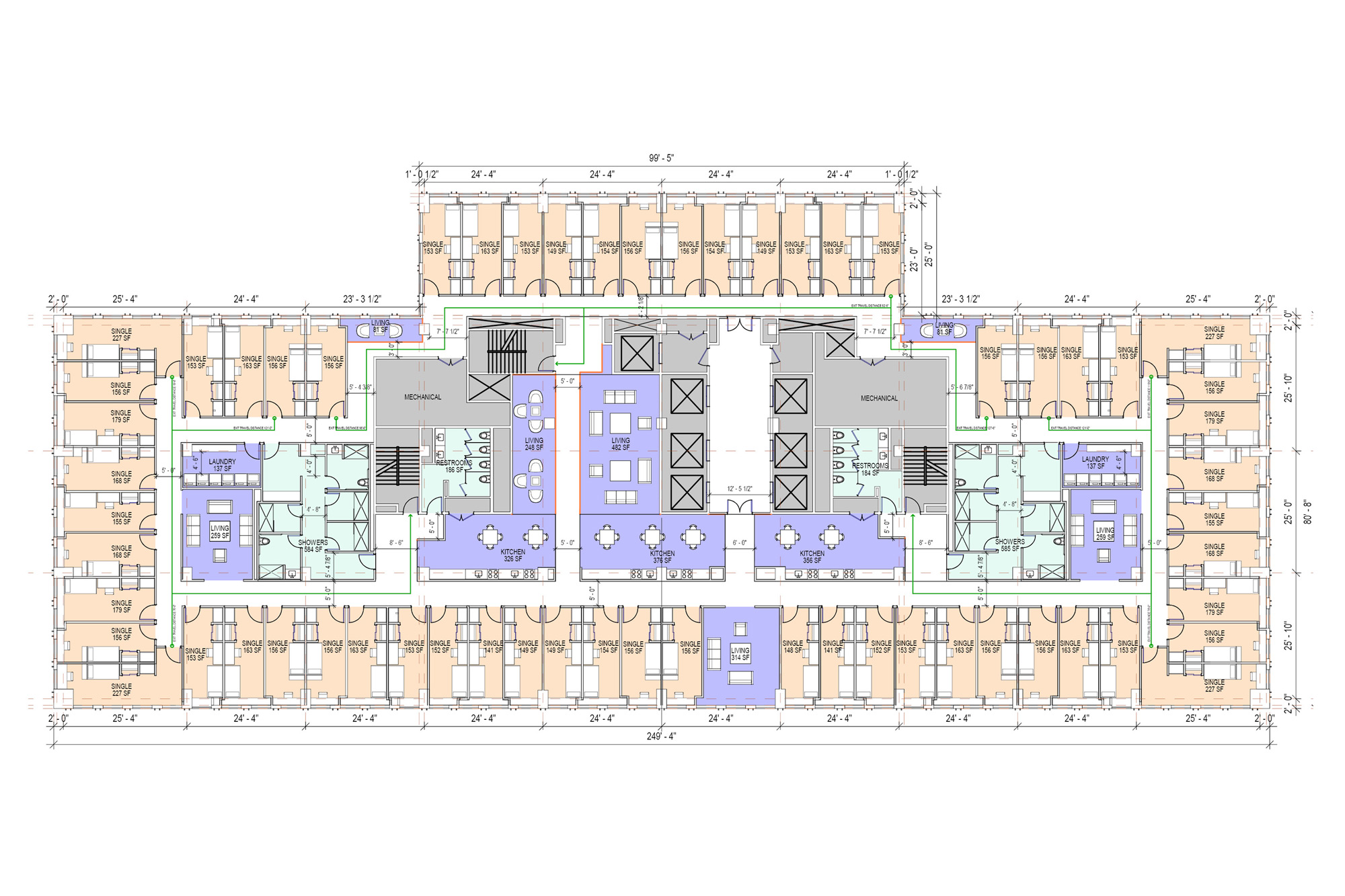

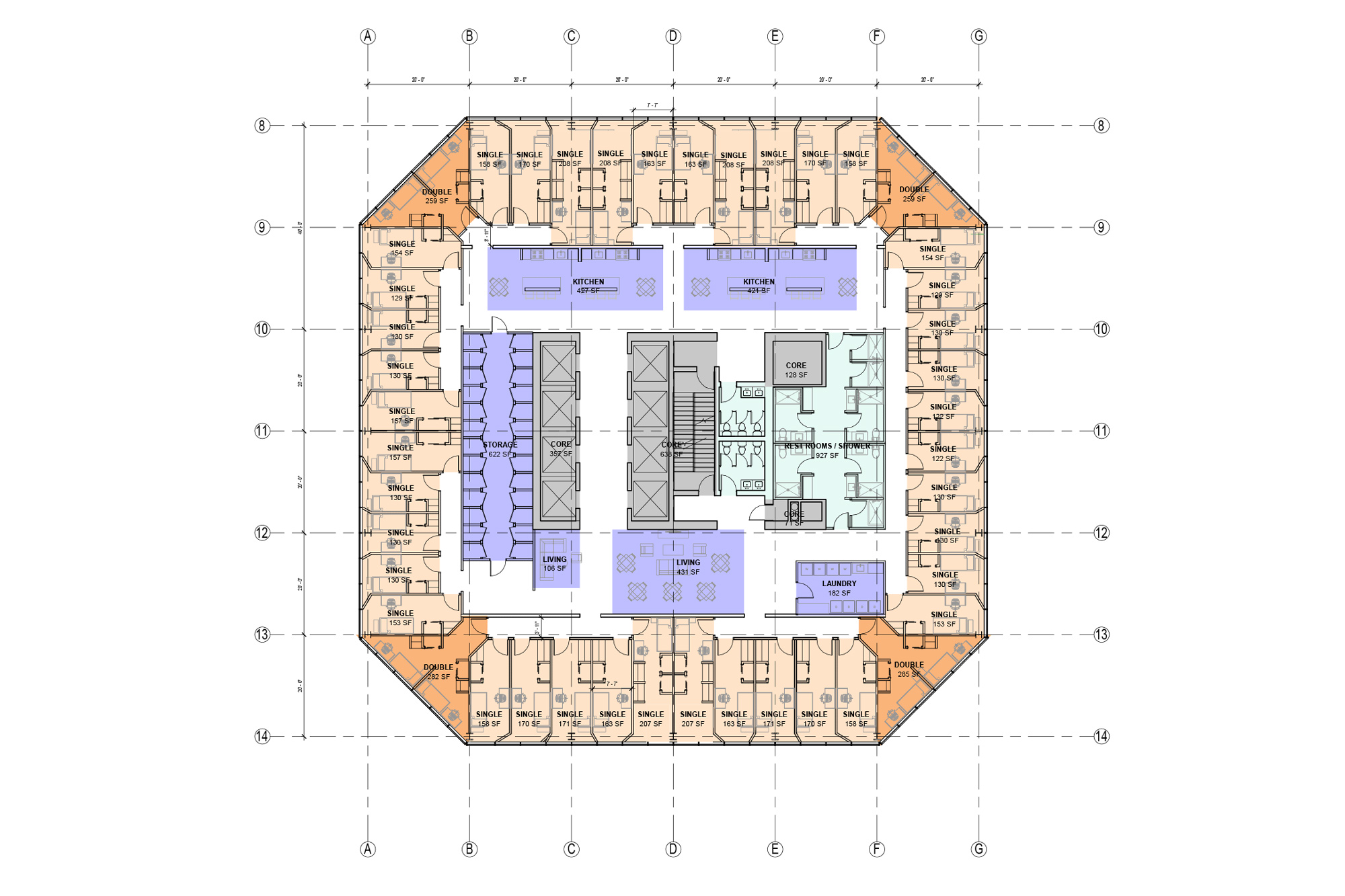

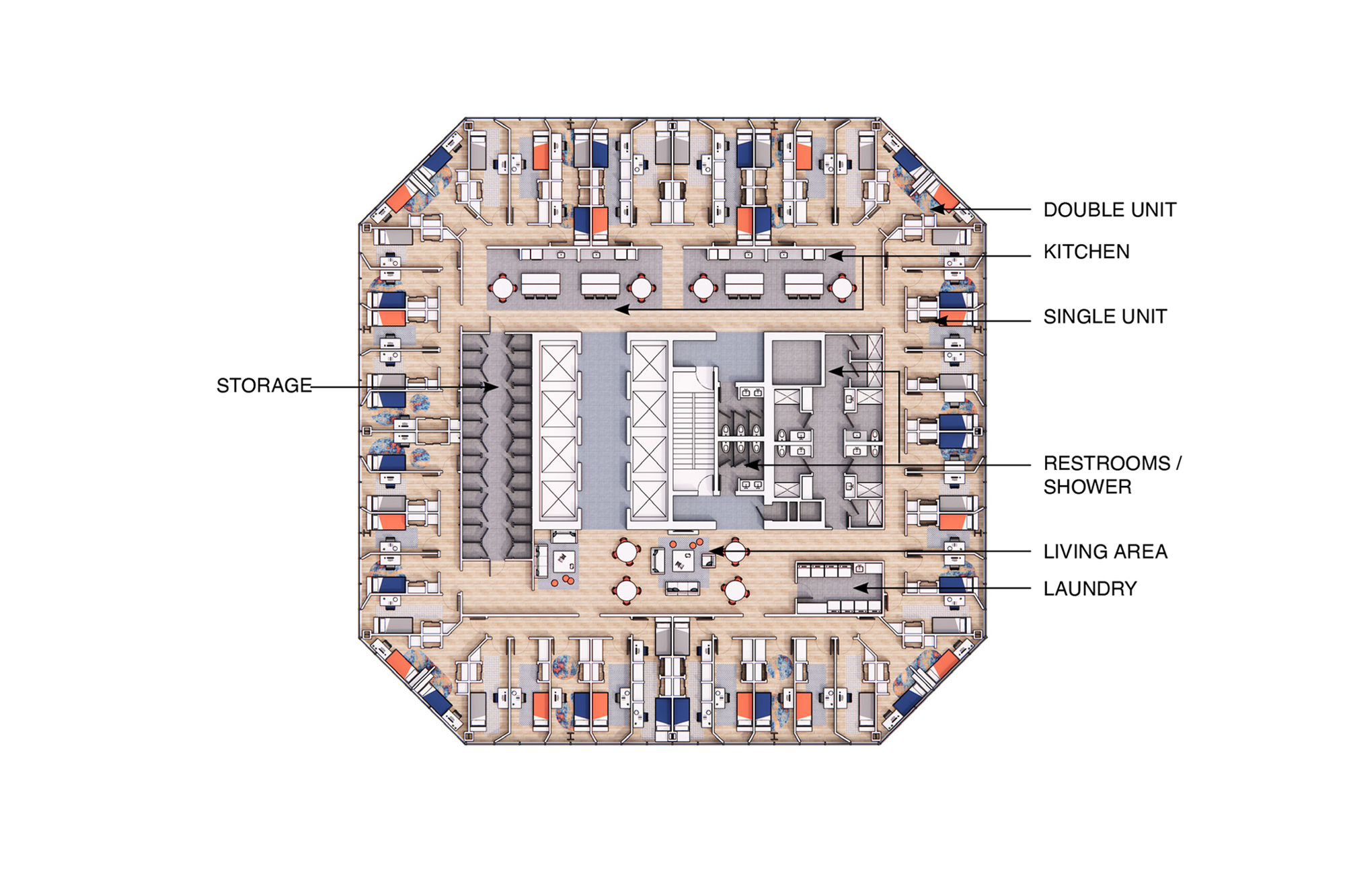

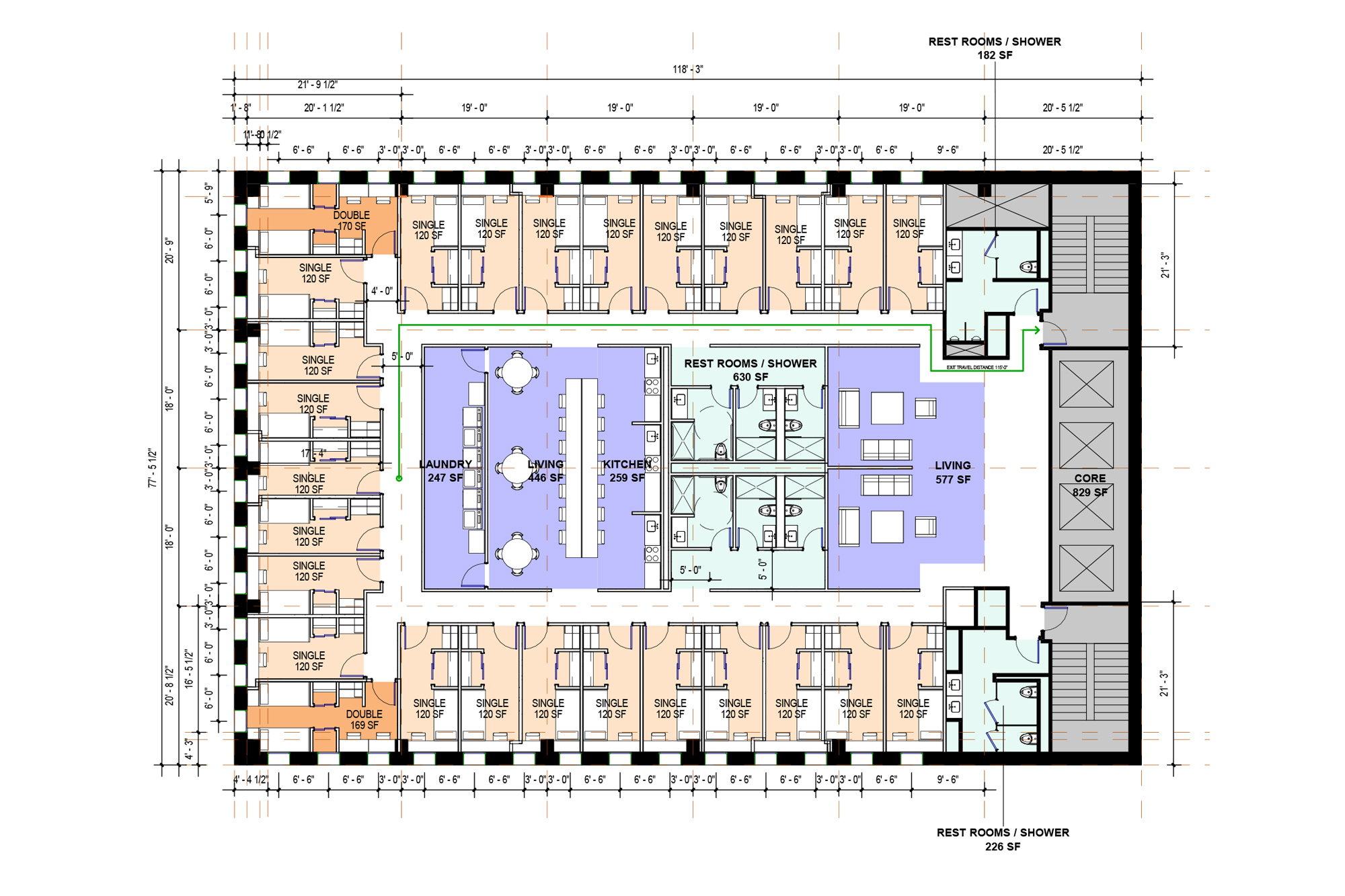

Gensler and Pew identified building typologies in each market that are suitable for co-living conversion and developed floor plans (prototypes) for each, factoring in mechanical, electrical, and plumbing systems. Each floor features private, “micro-units” with locks along the perimeter, and shared kitchens, bathrooms, laundry, and living rooms in the center.

Partnering with Turner Construction, costs were examined for renovations and labor. Additionally, the team developed an operating pro forma and financial feasibility analysis to assess the co-living conversion model’s viability as a real estate model.

Results and Findings

Utilizing the plumbing from kitchens and restrooms that are typical in office buildings, rather than adding new elements to individual units, reduced construction costs by 25% to 35% compared to conventional office-to-residential conversions on a cost per sq. ft. basis. The units offer private, secured dwelling rooms and large windows for every resident and can accommodate space for three times as many apartments as a traditional residential building.

We also found a sizable potential market for this concept. In each of the cities studied, anywhere from 38% to 58% of all renters are single-occupant households, and the concept can deliver units that are significantly more affordable than the average market-rate studio in each city’s downtown.

The report states:

Adding large amounts of this low-cost, downtown housing would provide a much-needed option for students, service-industry workers, young professionals, veterans, new arrivals in a city, and retirees. It would also reduce homelessness. And because of these units’ small size, the current low prices for office buildings, and the efficient layout, this housing could be created near jobs and transit at a fraction of the cost of traditional houses or apartments.

From a financial feasibility standpoint, we found that the concept may generate an anticipated rate of return that may still require some degree of public subsidy. However, the units produced per subsidy dollar would far exceed the impact of existing affordable housing delivery models.

Converting vacant buildings in these urban areas maintains accessibility to jobs and public transportation while the flexible co-living concept unlocks additional office-to-residential conversion opportunities. Policymakers can consider supporting the implementation of office-to-flexible co-living conversions due to the outsized impact that the concept has on housing production in an area of critical need. If successful, cities will be able to deliver low-cost housing in a much more efficient and cost-effective manner, providing thousands of secure, modern, and attractive homes to our nation’s downtowns.

For media inquiries, email .